CTV Uncovered 2023 : How Connected TV is becoming Convergence TV

The deepening convergence of linear and digital TV is increasingly being recognised across the TV advertising industry. In the UK, the leading body for audience measurement BARB Audiences Ltd recently announced the extension of its audience measurement to include fit-for-TV content by adding premium, professionally managed content on video-sharing platforms to its remit. This commitment was driven in large part by the growing number of access points audiences now have to enjoy TV-like video content.

To learn more about how audiences’ consumption habits are diversifying, to delve into channel & platform preferences, and to gather opinions towards TV advertising, AudienceXpress collaborated with online consumer research specialist Happydemics for the third iteration of its Streaming Video: CTV Uncovered 2023 consumer study.

Conducted across the UK, France, Germany, Italy, Spain and the Netherlands (EU6), the representative study revealed that viewers across Europe are continuing to be drawn to emerging channels and platforms. So, based on the consumer research with Happydemics, what are the current audience trends shaping the TV landscape? What are the main CTV consumption habits and behaviours in Europe?

EU6 viewers are connected with a multi-platform approach to content

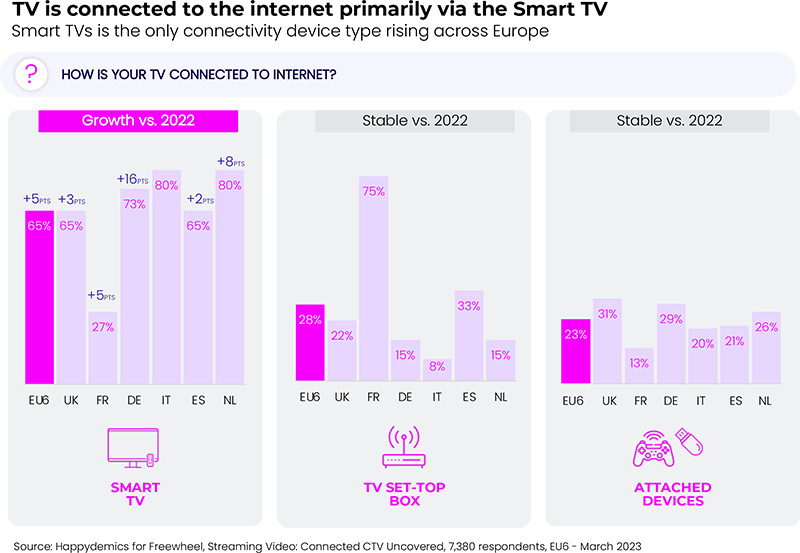

With the rise of streaming platforms, there were reports of the final straw for television. A few years later, a different conclusion may be drawn. As viewing habits evolve, the whole face of TV advertising is changing. TV content is everywhere and it embraces different formats, types and schedules. Television is very much alive and Connected TV has become the new normal. Smart TVs penetration is rising rapidly in Europe, with 65% of European viewers who have now connected their TV to the internet, directly through Smart TVs, an increase of 5% since 2022. France is the exception to this trend, as in France the TV is typically connected via a telecom operator set-top-box.

When using their connected TV, EU6 viewers surveyed turn largely to subscription-based video-on-demand (SVOD) for more than half of them closely followed by linear channels (48%) and catch-up (22%). It is significant that CTV viewers are now regularly using a broad overall mix of channels.

Drilling down into the specificities of some region, broadcaster video-on-demand (BVOD) is particularly favoured in the UK (20%), while the CTV audiences in the Netherlands have a notable preference for free on-demand services (15%).

Furthermore, just over half (51%) of EU6 respondents who own a CTV screen and watch free on-demand streaming platforms claim to do so more than they watch linear, with survey participants aged 15 to 34 most likely to show this habit. Age is a strong differentiator when it comes to video consumption.

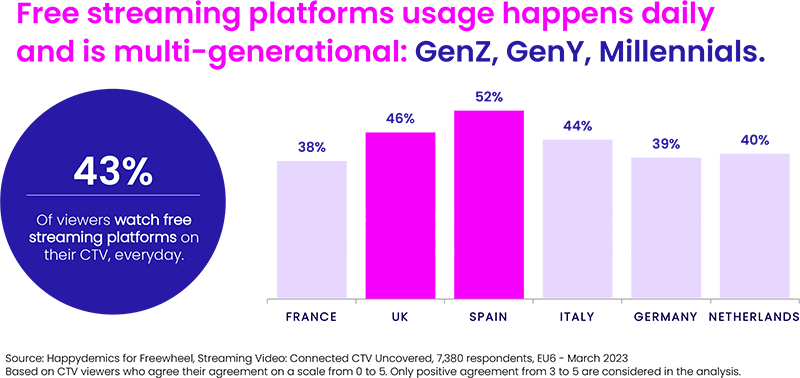

Over 43% of EU6 CTV viewers who use free on-demand streaming platforms tune in to them every day, while over half switch to watching these platforms when there is no content to their liking on linear TV. TV channels and AVOD platforms remain complementary to each other for European audiences.

The value of catch-up TV remains strong, as BVOD is the primary free on-demand platform of choice, for instance BBC iPlayer and All 4 in the UK, or MyTF1 and France.tv in the French market are one of the most used by European viewers who own a CTV.

Crafting an attention-grabbing ad experience

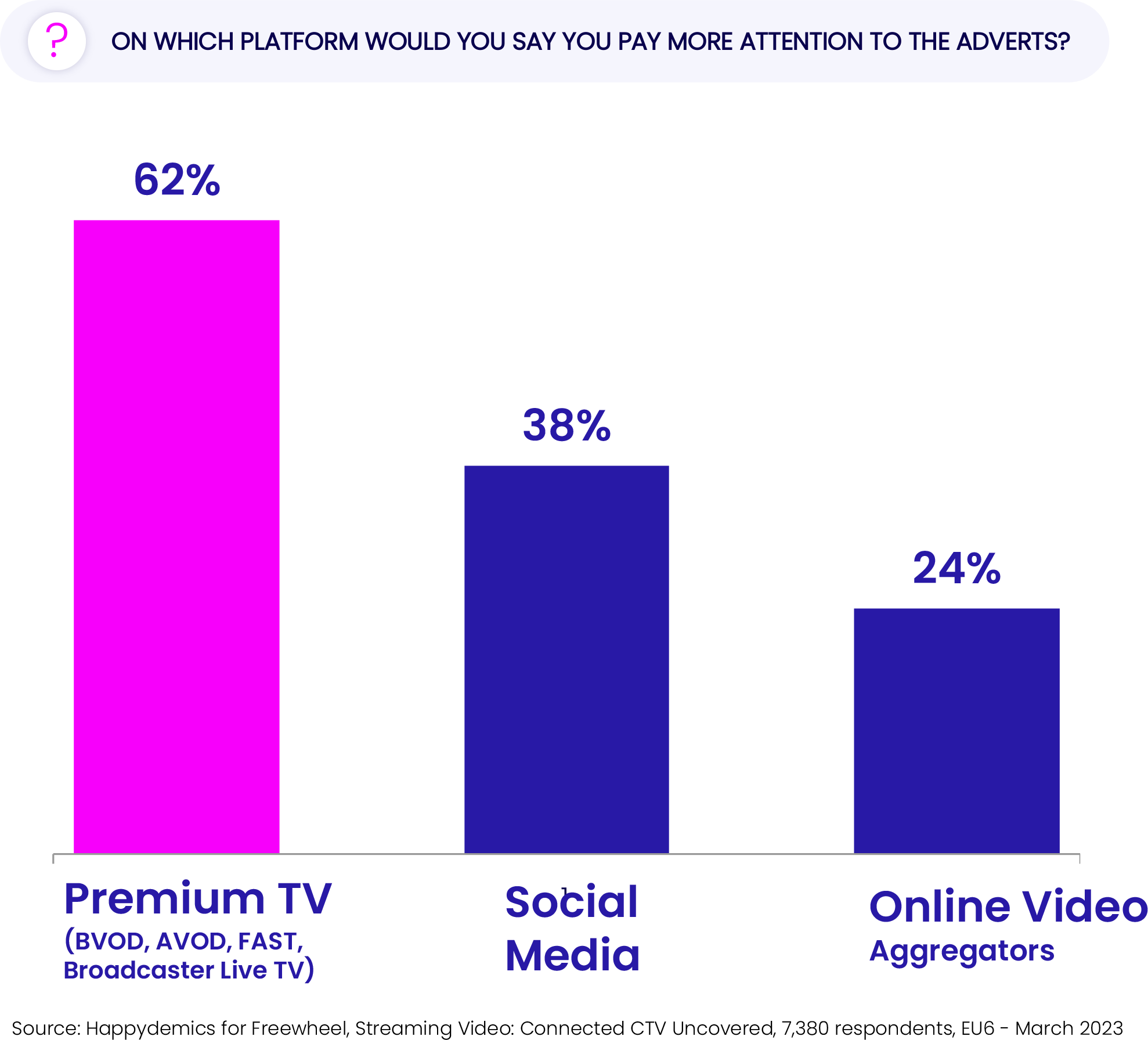

When considering the ad experience, viewers who have seen an advertising on different platforms consider that the premium content displayed in a TV-like environment is the most attention-grabbing.

On average, 26% of EU6 CTV viewers like contextual targeting, so the practice of displaying ads that reflect the content they are watching at the time, while 24% prefer geolocated advertising and 21% enjoy ads relevant to their personal interests. These findings were consistent across age ranges, emphasising the importance of tailored TV ads for all audiences. Contextual targeting is still new in Europe, but it is a promising alternative to third-party cookies.

As the linear-digital convergence continues, it is vital for brands and media companies to sustain the quality of the viewing experience by observing audience attitudes towards different forms of advertising. For example, about 70% of EU6 respondents with a CTV screen feel there are too many ads on social video aggregators, highlighting a key lesson to learn for industry players in the evolving TV landscape.

Capturing viewer attention across a growing selection of platforms and services is presenting a challenge for advertisers, underscoring the necessity of identifying the best channel mix for their campaigns. With free ad-supported streaming services and on-demand platforms earning traction among audiences, advertisers can take the opportunity to shape the advertising experience on these channels and contribute to increasing their appeal. By leveraging a complementary mix of linear and digital TV, advertisers can engage hard-to-reach audiences through premium video environments.

European Consumer Survey Infographic

EU6 Germany France UK Italy Spain NL

Methodology

Working with FreeWheel, Happydemics gathered preferences and opinions from over 7,380 CTV consumers in Europe. The answers were collected online between 31st January and 6th February 2023, forming part of a nationally representative study that included the UK (1,062), France (1,074), Germany (1,393), Spain (1,596), the Netherlands (1,183) and Italy (1,071), collectively referred to as the EU6.