2024 Advanced TV Uncovered: Confidence in Advanced TV remains high as marketers increasingly prioritise measurable impact

As the cost-of-living crisis continues and marketers (agencies and advertisers) are under pressure to achieve more with less, how are they adjusting their budgets and what are their priorities for the year ahead?

AudienceXpress worked with the independent media research firm CoLab Media Consulting to find out more. Between August and September 2023, CoLab surveyed 500 marketing decision makers or influencers in the UK, France, Germany, Italy, and Spain (EU5). Respondents were equally spread between agencies and advertisers.

The fourth iteration of AudienceXpress’ annual Advanced TV Uncovered survey aims to:

- Understand marketers’ marketing and spend priorities,

- Pinpoint accelerators and challenges for Advanced TV growth,

- Learn how advertisers and agencies are adapting to current market forces.

The findings highlight strong, ongoing optimism for Advanced TV, which includes video-on-demand (VOD), Connected TV (CTV), over-the-top (OTT), and addressable linear TV, although marketers are still experiencing a downward pressure on their budgets overall.

The bigger picture: cautious spending and a drive for customer loyalty

Almost seven out of 10 survey respondents expect their overall marketing budgets to stay stable or increase over the next 12 months, but caution remains with 32% predicting a decrease. EU5 marketers’ budget expectations are closely aligned for the year ahead, seeking to make the most of tighter budgets and find ways of demonstrating tangible results.

Due to the cost-of-living crisis, customer loyalty is on the decline and marketing priorities are changing in response. Retention is now the most important objective for 58% of marketers surveyed, jumping from the third place in 2023. This is closely followed by acquisition/win-back (54%) and growing revenue/market share (53%), which emphasises marketers’ continued focus on short-term results.

Demand for immediate impact is making measurement a priority

New measurement solutions are the top strategy priority for 62% of marketers surveyed, highlighting the need to prove the effectiveness of their campaigns. Retail media has surfaced as a key trend for 53% of respondents, as this channel provides valuable access to first-party data and a closed-loop measurement due to its proximity to the point of purchase.

Diving deeper into measurement priorities, understanding audience ‘attention’ is the top focus for almost half (48%) of agencies and advertisers surveyed, and 70% believe attention metrics are important to campaign measurement. This focus on attention could reframe the media value debate, better reflecting the impact Advanced TV delivers for brands, and potentially underpinning new trading models.

With newer metrics gaining traction, marketers appear to be keen to move away from gross ratings points (GRPs). Over half (53%) of those surveyed believe the TV advertising industry should retire GRPs, with Spain and France leading on this at 64% and 55% respectively. What’s interesting is that 80% of marketer respondents claim they are either ready to do without GRPs now or will be in the next 12 months.

Alongside more robust measurement, the pressure to deliver results is driving the need for efficiency. Automation ranks as the top data priority (59%) as programmatic trading capabilities advance across channels. This also raises questions around the search for cookieless targeting methods as the latest Google deadline looms. A little under half (46%) of advertiser respondents see identity graphs as the most viable alternative to third-party cookies, while agencies are less clear on the best solution. Agency respondents indicated a slight preference for publisher identifiers (42%), though they are equally split when it comes to ID solutions, contextual advertising, and user ID graphs (38%).

Advanced TV spend accelerates, with a strong trend for trial and repeat purchase

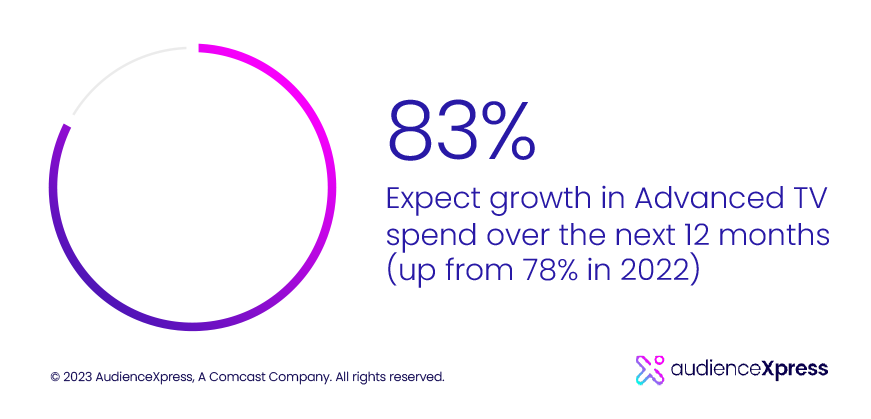

Confidence in Advanced TV remains strong with 83% of marketers surveyed expecting to increase their spend in the next 12 months, up 5% compared to last year, and agency expectations being particularly optimistic. German marketers seem the most upbeat about their Advanced TV spend intentions (85%), closely followed by Italian marketers (84%), who are also the most optimistic about their overall marketing budgets. Addressable linear TV and broadcasters’ video-on demand (BVOD) are likely to see the biggest increase from both advertisers and agencies across the EU5 countries.

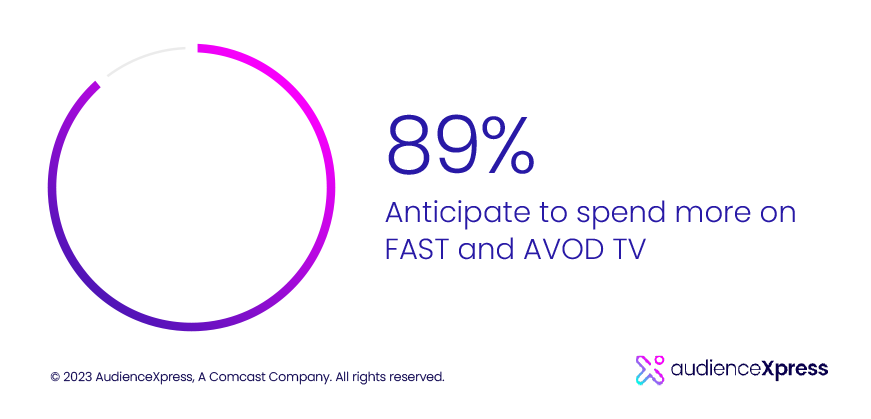

Free ad-supported streaming TV (FAST) and ad-supported video-on-demand (AVOD) spend is expected to grow, with 89% of marketers surveyed looking to allocate more budget to these channels in the coming year. Budget that is most likely to come from online video budgets as stated by 24% of marketers. Interestingly, the respondents who spend the highest proportion of their TV budget on Advanced TV (39%) say they expect the strongest growth, predicting an increase of 92%. This shows a clear relationship between trial and repeat purchase, underlining the importance of taking a test-and-learn approach to Advanced TV channels.

Reach extension and ad effectiveness drive Advanced TV growth

With OFCOM’s Media Nations 2023 report highlighting growing audience fragmentation and viewers’ shift to on-demand services, marketers are keen to expand the reach of their linear TV campaigns through Advanced TV. More than half (56%) of agencies and advertisers who participated in the survey see opportunities for reach extension as the biggest growth driver of Advanced TV spend.

Ad effectiveness is another top driver for Advanced TV budgets, according to 51% of marketers surveyed, with advertiser respondents (56%) more convinced of this than their agency peers (46%).

The ability to manage frequency and use advanced targeting techniques have slipped down the list of key drivers while Advanced TV’s brand safety is seen as a growth accelerator. Additionally, there’s been a lot of discussions about the lack of transparency in the digital supply chain and the rise of made-for-advertising sites (MFAs) have made media quality and premium video a key area of concern to marketers. 58% believe Advanced TV has become more important as a premium advertising environment.

Greater awareness is still a necessity for unlocking Advanced TV growth

For the second year running, 45% of survey respondents cite lack of awareness as the biggest inhibitor to Advanced TV growth, reinforcing the need for ongoing education to clearly define Advanced TV and demonstrate the value it brings to brands. These channels can enable marketers to meet the challenges surrounding customer data, targeting, convergent TV, brand building, and response marketing head on, but more must be done to demonstrate this.

Although marketers now seem more willing than last year to explore new media channels, they are still apprehensive about the challenges of managing linear and Advanced TV in a unified campaign. The survey respondents ranked supply fragmentation (29%) and buying complexity (28%) as core concerns for convergent TV buys, suggesting that streamlined access to a consolidated pool of Advanced TV inventory could help to further Advanced TV’s growth.

“While economic uncertainty continues to place marketing budgets under scrutiny and impact consumers’ loyalty to brands, advertisers and agencies are increasingly optimistic around Advanced TV’s ability to help them navigate these issues,” commented Massimo De Magistris, VP, Head of AudienceXpress International. “Its opportunities for reach extension can support their objectives of acquiring and winning back customers, attracting spend to these channels. Meanwhile simplifying the complexities of buying linear and Advanced TV in one transaction will also contribute to the continued growth in this space.”

Advanced TV definition:

In the survey we defined Advanced TV as any of the following types of TV advertising:

-

- VOD / Video on Demand (incl. BVOD – Broadcaster Video On Demand) (i.e. advertising around a programme that has previously aired on linear TV. (B)VOD can be targetable)

- Connected TV / OTT (i.e. ads appearing in smart TV apps, external devices – AppleTV, Amazon Fire, gaming consoles, etc – or Operator Set Top Box and log-in streaming apps)

- Addressable Linear TV (i.e. linear TV advertising that, through the use of data, can reach consumers at the household level)

Download report