European Marketers Survey

2023 Advanced TV Uncovered: Marketers prepared to weather the economic storm and stand firm on Advanced TV investments

With high inflation and rising living costs likely to influence consumer spending patterns, how are marketers across Europe planning to respond? AudienceXpress enlisted the independent media research firm CoLab Media Consulting to find out. Between 18 July and 22 July 2022, CoLab surveyed 500 marketing decision-makers and influencers in the UK, France, Germany, Italy, and Spain (EU5). This EU5 Marketers Survey, conducted annually since 2020, seeks to:

- Determine advertiser and agency marketing spend priorities,

- Identify key drivers and inhibitors for Advanced TV* growth,

- Uncover ongoing changes in light of market forces.

The results from this year’s survey reveal that marketers are cautious overall but increasingly enthusiastic about investing in Advanced TV, which includes video-on-demand (VOD), Connected TV (CTV), over-the-top (OTT), and addressable linear TV.

Marketers won’t ‘go dark’

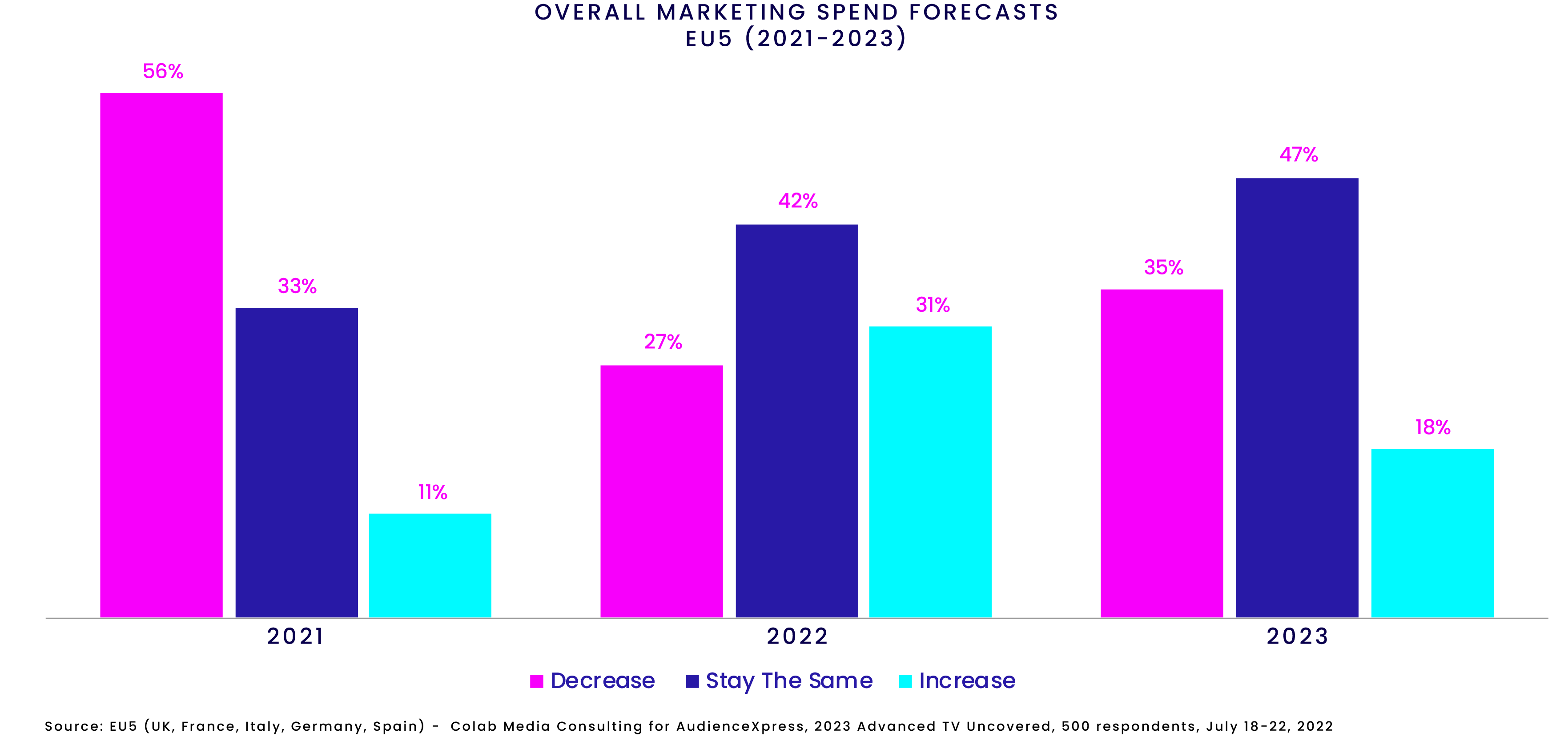

Two-thirds of respondents intend to maintain or increase spending and continue marketing activity, even though present economic and geo-political concerns have impacted optimism. Confidence in Advanced TV remains particularly strong, with 78% of survey participants expecting to increase their investment in these marketing channels.

UK marketers are rather pessimistic, with just 17% expecting their budgets to increase and 47% expecting decreases. In France, on the other hand, 29% of marketers surveyed expect uplifts to spending, while only 27% believe cuts are coming.

It is a widely discussed phenomenon that continuing to invest in marketing during difficult periods can ensure long-term growth; now it appears that marketers, in large part, are reflecting this sentiment in their spending plans. This appears especially true in Germany where brand building is in the top 3 marketing priorities (23%), the highest percentage of all EU5 countries. So, as advertisers and agencies aim to sustain marketing budgets, what are their priorities for the next year?

All eyes on customer acquisition and market share

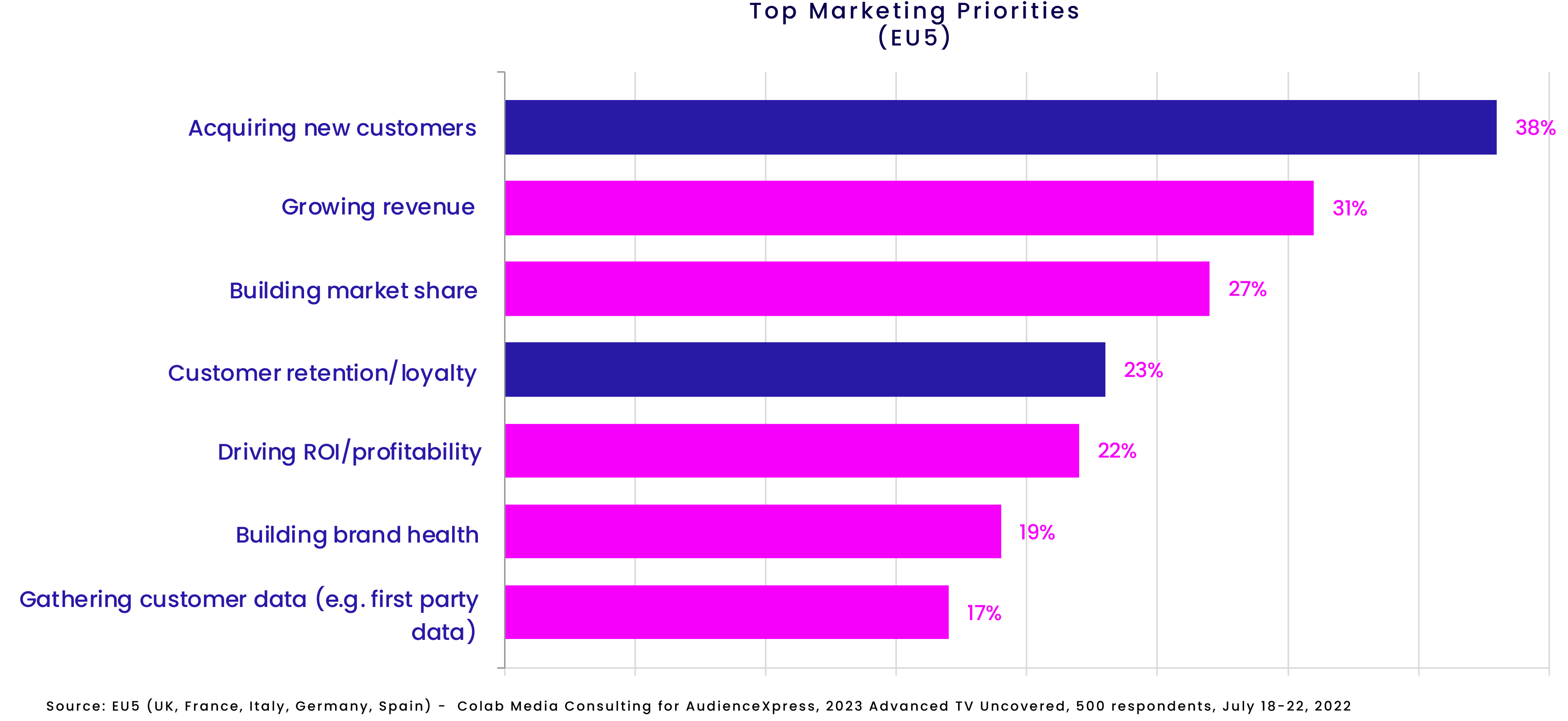

In line with the previous two years, the EU5 marketers surveyed remain focused on upper-funnel metrics such as acquiring customers and expanding market share. As demonstrated in our previous survey, customer bases shrank in 2020, increasing the need for marketers to prioritise customer acquisition while also building market share.

Soaring inflation is increasing the likelihood of consumers being more price sensitive and less loyal to specific brands. Although brand building is a useful tool for both boosting awareness and reducing this price-sensitivity, it is only a priority for 19% of survey participants.

There is a notable difference between agencies and advertisers, however, when it comes to prioritising lower-funnel objectives. Agencies seem more focused on customer retention and nurturing brand loyalty, which are typically more cost-effective than acquisition, and therefore more aligned to tighter budgets. With inflationary pressure kicking in, loyalty and retention will potentially become a vital business metric moving forward.

Aligning with marketers’ priority of customer acquisition, maximised reach is now considered the top indicator of campaign effectiveness as brands aim to connect with new consumers. This is a shift from the previous survey, in which respondents ranked reach and optimised creative as equally important. This shift could be fuelling the IPA’s long-reported crisis in creative effectiveness; marketers should keep in mind the importance of balancing reach with other drivers such as creative optimisation and context to achieve truly effective campaigns.

Advanced TV is integral to marketers’ media plans

The outlook for Advanced TV, remains positive, with half of the marketers surveyed happy with their current level of spend in these channels. A further 45%, meanwhile, would like to increase their budgets in the coming year, indicating growing confidence in Advanced TV channels.

Across the EU5 countries, agencies appear more optimistic than advertisers and are generally increasing their spending plans for broadcaster video-on-demand and CTV. Compared to last year, marketers are also increasing spending for linear addressable TV, but to a lesser extent than the other channels. According to the surveyed marketers, despite CTV remaining the most efficient channel for ad effectiveness, brand building, targeting and reach extension, VOD is still expected to experience the strongest growth, with results in Germany and Italy indicate a difference of over 20% in comparison to CTV.

Remarkable appetite for ad-supported VOD platforms continues

The past 12 months have seen a significant growth in ad-supported video-on-demand (AVOD) and free ad-supported streaming TV (FAST) thanks to the ongoing proliferation of platforms, as well as subscription-based services adopting hybrid models.

As a result, almost nine in 10 of marketers surveyed intend to raise their investment in these channels. Interestingly, for half of respondents, this spend will come from digital budgets, which covers online video, social, and display advertising, while 21% will redirect TV budgets. In complex times like this, marketers should consider turning to premium video environments to access quality inventory, reach viewers at scale, and maximise ROAS.

Data targeting and ad effectiveness: the key drivers of Advanced TV growth

With the first signs of a recession hovering over the economy, marketing budgets are once again under scrutiny. It is no surprise, therefore, that proven higher ad effectiveness is the biggest driver of Advanced TV spend. More sophisticated, audience-based and cross-screen targeting methods are also capturing investment for Advanced TV channels, as they enable marketers to successfully connect with desired audiences and achieve campaign objectives.

In a shift from last year, frequency management on Advanced TV channels has attracted greater interest than reach extension for traditional TV campaigns. This could indicate a pressure to ensure efficiency even while marketers prioritise maximised reach in their campaigns. Agencies, however, consider the ability to extend traditional TV’s reach to be a bigger driver of spend than advertisers, perhaps because of their closer proximity to campaign planning. This is likely to make them more sensitive to the challenges of driving incremental reach. Advertisers can lack the expertise and infrastructure to achieve this reach programmatically, presenting a potential opportunity for agencies to add even more value in the campaign delivery phase.

Improving awareness and measurement tools will further Advanced TV growth

In the EU5 Marketers survey 2021, the inability to monitor campaign performance was seen as a major inhibitor to Advanced TV. This year, while measurement still appears to be front of mind for marketers, the prime inhibitor of Advanced TV growth is a lack of awareness around what Advanced TV is. Further education and proof points will be needed to build confidence in the various channels – especially for advertisers.

Agencies, on the other hand, have consistently ranked the need for accurate audience measurement and campaign planning capabilities as a key inhibitor since 2020. Given that agencies are typically responsible for post-campaign reporting, this concern demonstrates the need for viable campaign measurement solutions.

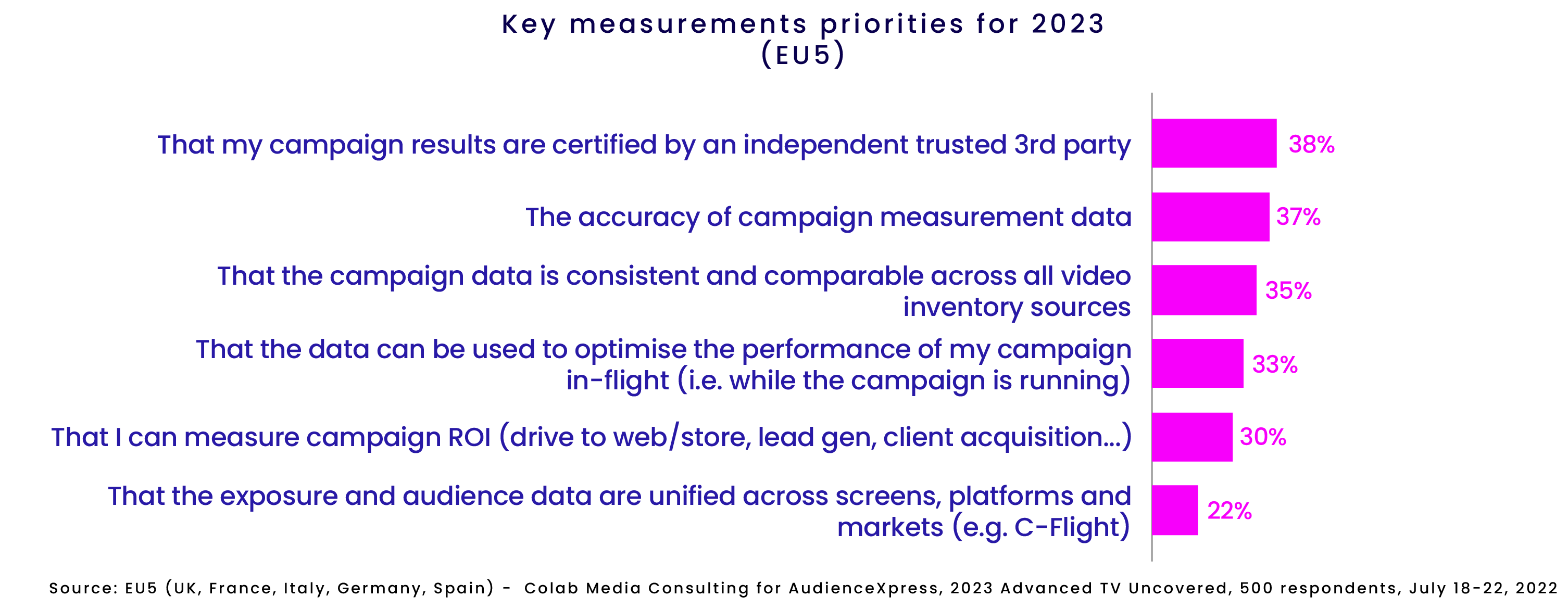

Zooming in on measurement priorities, marketers are seeking independent third parties to verify their campaign results. With no standardised measurement across platforms and screens, marketers are eager for third-party providers to deliver on this. The ability to compare campaign performance across channels will support marketers’ goal of efficiently driving incremental reach and prove the impact of scrutinised budgets. Additionally, agencies are focused on consolidating campaign reporting, so they can understand and compare results across all inventory sources.

Despite the downward pressure on budgets, businesses are staying mindful of the commercial benefits that come from marketing through economic downturns. Learning from past experiences, the majority of brands do not plan on ‘going dark’ in the year ahead.

“Although marketers are preparing for difficult times, Advanced TV and ad-supported VOD in particular appear to be in a strong position due to their automated capabilities to buy and optimise campaigns, as well as the ability to reach desired audiences,” shared Massimo de Magistris, VP, Demand Sales & Strategy of AudienceXpress. “AudienceXpress is progressing cross-screen audience targeting and campaign measurement to address advertisers and agencies’ key priorities. Marketers want direct access to major TV and premium digital video providers across all screens and formats, as well as the ability to report on the impact of their campaigns as they aim to boost reach and customer acquisition in 2023.”

Advanced TV Infographic

EU5 Germany France UK Italy Spain

* Advanced TV definition:

In the survey we defined Advanced TV as any of the following types of TV advertising:

- VOD / Video on Demand (incl. BVOD – Broadcaster Video On Demand) (i.e. advertising around a programme that has previously aired on linear TV. (B)VOD can be targetable)

- Connected TV / OTT (i.e. ads appearing in smart TV apps, external devices – AppleTV, Amazon Fire, gaming consoles, etc – or Operator Set Top Box and log-in streaming apps)

- Addressable Linear TV (i.e. linear TV advertising that, through the use of data, can reach consumers at the household level)

This research was conducted by independent media research firm CoLab Media Consulting between 18 and 22 July 2022. The research, commissioned by AudienceXpress, FreeWheel’s premium video media sales house, is an attempt to understand how Marketers – 500 advertisers and agencies – across five European countries (UK, France, Germany, Italy and Spain) are adapting to the current market forces; how they are adjusting spending priorities and preparing for the year ahead.